HCA Healthcare is a collaborative healthcare network, driven by physicians, nurses, and colleagues helping one another champion the practice of

Continue reading

HCA Healthcare is a collaborative healthcare network, driven by physicians, nurses, and colleagues helping one another champion the practice of

Continue reading

Pet insurance helps protect your furry friends from unexpected vet bills so they can get the care they need without

Continue reading

In this article, we will walk you through the steps to activate Discover credit card online at discover.com/activate, over the

Continue reading

In this article, we will be walking you through everything you need to know about installing and sign in Netflix

Continue reading

Ever thinking of moving to the USA? Do you have skills that can get you a better living? Well, on

Continue reading

As individuals enter their golden years, securing reliable and low-cost life insurance becomes a crucial consideration. Fortunately, there are tailored

Continue reading

In an age where digital privacy is a growing concern, users are seeking ways to safeguard their personal information on

Continue reading

The Dalian University of Technology (DUT) is extending a significant educational opportunity through the Chinese Government Scholarship – High Level

Continue reading

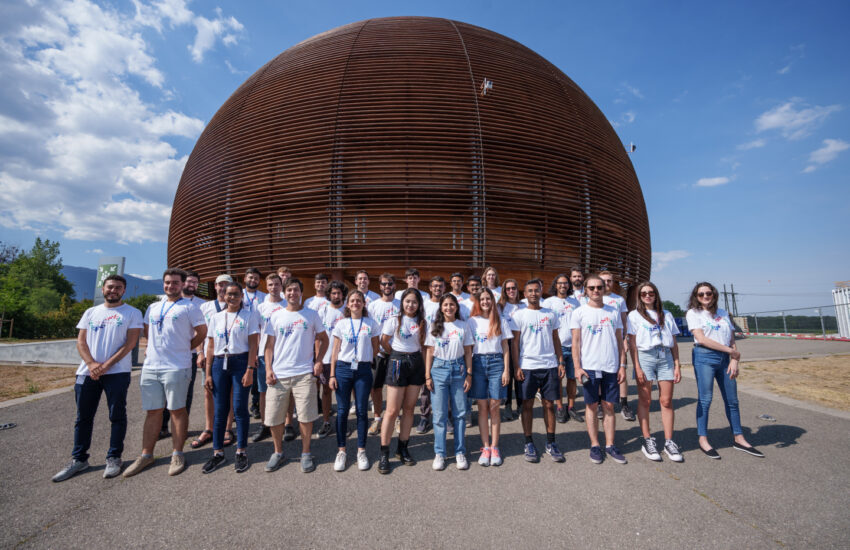

The CERN Internship Programme stands as a beacon for impassioned students seeking an unparalleled chance to immerse themselves in the

Continue reading

In today’s article we’ll be discussing how to Activate North Lane (Wirecard) at login.wirecard.com/activate Wirecard, now known as North

Continue reading